Now that the revenue account is closed, next we close the expense accounts. You must close each account; you cannot just do an entry to “expenses”. If the balances journal entry definition in the expense accounts are debits, how do you bring the balances to zero? The debit to income summary should agree to total expenses on the Income Statement.

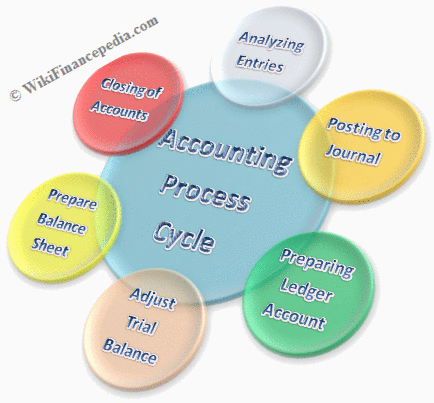

Thus, shifting revenue out of the income statement means debiting the revenue account for the total amount of revenue recorded in the period, and crediting the income summary account. At the end of a period, all the income and expense accounts transfer their balances to the income summary account. The income summary account holds these balances until final closing entries are made. Then the income summary account is zeroed out and transfers its balance to the retained earnings (for corporations) or capital accounts (for partnerships). This transfers the income or loss from an income statement account to a balance sheet account. The income summary account is defined as the account of temporary or provisional in nature wherein the statement at the end of the accounting period net off all the closing entries of expenses and revenue accounts.

How to Use the Income Summary Account?

Fiduciary funds should be used to report assets that are held in a trustee or agency capacity for others and that cannot be used to support the government’s own programs. Required fiduciary fund statements are a statement of fiduciary net assets and a statement of changes in fiduciary net assets. The government-wide statement of activities should be presented in a format that reports expenses reduced by program revenues, resulting in a measurement of “net (expense) revenue” for each of the government’s functions. General revenues, such as taxes, and special and extraordinary items should be reported separately, ultimately arriving at the change in net assets for the period. Special items are significant transactions or other events that are either unusual or infrequent and are within the control of management.

However, it remains a key concept in understanding how the accounting cycle works, especially in manual or educational contexts. The Income Summary is very temporary since it has a zero balance throughout the year until the year-end closing entries are made. Next, the balance resulting from the closing entries will be moved to Retained Earnings (if a corporation) or the owner’s capital account (if a sole proprietorship). The detailed authoritative standards established by this Statement are presented in paragraphs 3 through 166. The reasons for the Board’s conclusions on the major issues are discussed in the Basis for Conclusions (Appendix B).

The Importance of an Income Statement

Vertical analysis refers to the method of financial analysis where each line item is listed as a percentage of a base figure within the statement. This means line items on income statements are stated in percentages of gross sales, instead of in exact amounts of money, such as dollars. The purpose of an income statement is to show a company’s financial performance over a given time period. It tells the financial story of a business’s operating activities. Prospective reporting of general infrastructure assets is required at the effective dates of this Statement. Retroactive reporting of all major general governmental infrastructure assets is encouraged at that date.

Some senior residents face a difficult decision during heat wave … – WJXT News4JAX

Some senior residents face a difficult decision during heat wave ….

Posted: Thu, 29 Jun 2023 01:02:17 GMT [source]

After all temporary accounts have been transferred to the income summary account, the balance in each temporary account will be closed and transferred to the capital account for a sole proprietorship or to “retained earnings” for a corporation. It is used when a company chooses to transfer the balance of individual revenue and expense accounts directly to retained earnings or when a company chooses to close the books using an income statement. The income summary account is an intermediate account that is used to close the books. It is used when a company chooses to transfer the balance of individual revenue and expense accounts directly to retained earnings. The income summary account is also used when a company chooses to close the books using an income statement. Most governmental utilities and private-sector companies use accrual accounting.

Explanation of Income Summary Account

Help the management prepare the income summary for the financial year ending. MD&A should provide an objective and easily readable analysis of the government’s financial activities based on currently known facts, decisions, or conditions. MD&A should include comparisons of the current year to the prior year based on the government-wide information. It should provide an analysis of the government’s overall financial position and results of operations to assist users in assessing whether that financial position has improved or deteriorated as a result of the year’s activities. In addition, it should provide an analysis of significant changes that occur in funds and significant budget variances.

Download our free course flowchart to determine which best aligns with your goals. Because of this, horizontal analysis is important to investors and analysts. By conducting a horizontal analysis, you can tell what’s been driving an organization’s financial performance over the years and spot trends and growth patterns, line item by line item. Ultimately, horizontal analysis is used to identify trends over time—comparisons from Q1 to Q2, for example—instead of revealing how individual line items relate to others.

How to calculate income?

How to calculate annual income. To calculate an annual salary, multiply the gross pay (before tax deductions) by the number of pay periods per year. For example, if an employee earns $1,500 per week, the individual's annual income would be 1,500 x 52 = $78,000.