This is what makes technical analysis almost a self-fulfilling trend. Academics with advanced statistical training disagree among themselves as much as traders in online discussions. To offer you a balanced view, here are three papers that do not support technical analysis. Take note that many studies suggest that Asian markets work better with technical analysis.

You are trading alongside day traders, swing traders, and investors, all of whom may have different price targets. For example, $23.50 may seem like an insignificant price point on an intra-day chart, however that may be a long-term support level on a daily or weekly chart. Make sure to understand support and resistance levels across intra-day, daily, and weekly charts. Straightforward Technical Analysis for Beginners is facilitated by a forex and cryptocurrency trader. The class begins with a brief overview, followed by segments on candlesticks, support and resistance levels, popular chart indicators and chart patterns. Your trading analysis expertise can impact how well you make decisions.

Southern New Hampshire University Online

Portfolio managers use technical analysis alongside fundamental analysis to identify investment opportunities for their clients. Generally, any investor who used technical analysis is trying to maximize their return on investment. You start off with some basic core concepts like how to look at a chart, price bars, candlestick analysis, trading gaps, etc. You then move on to more advanced topics covering chart pattern recognition, moving averages, momentum, volatility, etc. There are plenty of practical examples to really help cement the concept and fun little tidbits and insights liberally strewn around.

It tells you that the buyers weren’t as strong compared to the previous high and it now leans toward the area of support, otherwise known as a neckline. The Flag pattern pretty much looks like the usual flag we see in the real world that’s waving left and right. Again, the way you draw an ascending triangle is a way you use your drawing tools as discussed a while ago.

What is Technical Analysis?

The goal is to limit your risk by preventing you from stopping out of a trade too early. For example, let’s say you buy a stock at $20.50 expecting support to be at $20. The stock pulls to $20, you get stopped out and the stock bounces off $19.95 before trending upwards. If you had given yourself more breathing room, the trade may have worked out in your favor. Anticipation can provide better entries with less certainty whereas waiting for confirmation provides higher certainty at the expense of a later entry. Nonetheless, the general takeaway is to derive trading ideas from inter-market analysis.

- Today, NYIF is one of the leading names when it comes to financial education, especially when it comes to trading.

- A stock with a $0.10 intra-day price range provides very little opportunity to most traders.

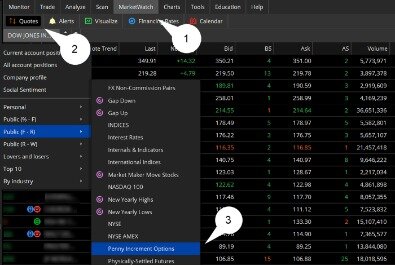

- The chart below provides an overview of the activities for Lesson 11.

- Next, we’re going to think about an “edge” in the market, where do people look for and find an edge, and last what is technical analysis.

- The section goes on to teach you how to use the many chart analysis tools available through StockCharts.

- The higher the level of service, the quicker refreshing of the data.

If you are interested in this course, please visit the Investopedia Academy. The overall best technical analysis course, as determined by Investopedia, is through Udemy, but other highly-ranked ones include Bullish Bears, and The Chart Guys. Here are 3 ways you can get fresh, actionable alerts every single day. It can be helpful to differentiate between legitimate and artificial price movement, even if your strategy is primarily technical. These are hypothetical examples, but the broader lesson remains the same. This does NOT mean you should increase your risk exposure on every trade.

Stock Market Trading: The Complete Technical Analysis Course

Register today to unlock a vault of resources that includes 7.5 hours of on-demand video, 7 articles, 8 downloadable resources and 2 practice tests. CourseMarks, which helps students find the best classes based on student feedback and content freshness and diversity, gives the Technical Analysis Masterclass a rating of 9.8 out of 10. Udemy is known for bringing world-class instructors to its education platform, and Jyoti Bansal is no exception. She is a double-Certified Technical Analyst with deep industry experience. As evidenced by the more than 55,000 students who’ve taken her class with over 11,000 positive reviews, Jyoti really delivers in the class. Gordon Scott has been an active investor and technical analyst or 20+ years.

When you make almost any purchase, you focus on the price of the product itself. You don’t focus on WHY it is priced that way because that would turn your 30-minute grocery shopping trip into a 4-hour expedition. For the most part, we assume that products are priced to meet the market’s demands. In the world of trading, when someone says “technical analysis”, the first thing that comes to mind is a chart.

Chapter – 3 Concept of Support & Resistance

Psychology, believe it or not, plays a vital role in your trading success. Just like a game of chess, you must master the psychology of trading if you want to become a master. Understand the basic knowledge like chart patterns and risk management to gain a thorough understanding of both individual and crowd psychology.

This is purely because the chart pattern caused by the security’s price action signals it to be a sound investment. Technical analysis can be very lucrative for short-term trading, whereas fundamental analysis tends to be a better trading strategy for the long term. It’s important to keep in mind that support/resistance levels exist across multiple timeframes.

You might recognize JC from one of his many appearances on the major financial media outlets. Fortunately for his many students, one of his strengths is translating complex concepts into terms anyone can understand. Its educational library consists of courses, reference materials, and educational videos. All of this is conducted in the context of a 24/7 trading community. With its seven modules and 40 lessons of on-demand video content, the beginner’s course ranks high as one of the best free course offerings.

You also agree to read the Product Disclosure Statements issued by your advisor, broker or market maker before trading and consult them as to the appropriateness of trading for you. You also indemnify us and our agents from any losses or consequential damage you may incur from using these methods. You may be asked to sign and indicate you understand & accept this Warning.

While it’s not an exact science, successful traders who master technical analysis get it right much more often than they get it wrong. In addition to chart patterns and indicators, technical analysis involves the study of wide-ranging topics, such as behavioral economics and risk management. The goal behind technical analysis is usually to identify trading opportunities and capitalize on them using a disciplined, rules-based approach that maximizes long-term risk-adjusted returns.

You will slow yourself down decrease your efficiency as a trader. Instead, focus on technical indicators that actually help you improve your decision making. For example, we often use VWAP to gauge a stock’s relative strength on an intra-day chart. Similarly, many traders will use stochastics, RSI, and MACD to do the same.

Technical Analysis, Day 4: Learning Lessons – International Judo Federation

Technical Analysis, Day 4: Learning Lessons.

Posted: Sat, 27 Aug 2022 07:00:00 GMT [source]

Recall, the Donchian Channel can serve as an entry trigger to buy breakouts and short break downs. Later, we’ll look at this back again and teach you how you can surely use this as part of your trading strategy. The market moves from a period of low volatility to a period of high volatility. It’s because the range of the candles is getting smaller and smaller, and that’s why your ATR value is decreasing. This is a very simple entry trigger to get on-board the trend if the Moving Average serves as an area of value.

All of these different groups rely on different analytical tools. One of the ways you can do this is by analyzing charts across multiple timeframes. Technical analysis operates under the premise that a stock’s price movement accounts for all factors. Whereas investors may be focused on industry trends, company management, and accounting ratios, day traders focus primarily on price. This simplified form of analysis allows traders to make quick decisions that allow them to operate more efficiently. Technical analysis is the use of charts and statistics to analyse the direction of markets and identify entry and exit points for trades.

We’ll go over a few basic tips for making the most of technical analysis. We introduce people to the world of trading currencies, both fiat and crypto, through our non-drowsy educational content and tools. We’re also a community of traders that support each other on our daily trading journey. The course starts off with an introduction to machine learning, trading and the Google cloud platform.

COVID-19 surveillance in Democratic Republic of Congo, Nigeria … – BMC Public Health

COVID-19 surveillance in Democratic Republic of Congo, Nigeria ….

Posted: Mon, 08 May 2023 10:43:49 GMT [source]

This makes it easy for the markets to trigger your stop loss and reverse back to your intended direction. When the price is above the 200-period Moving Average, stay in a long bias. You divide it by 20 (the period of the Moving Average) and you’ll have a value of $10. What it does is that it adds up the value of the last 20 candles. A Moving Average is pretty much an indicator that summarizes past prices. Because I’m going to share with you the different types of indicators out there so that you would see indicators in a different light.

Led by Certified Technical Analyst Jyoti Bansal, Udemy’s Technical Analysis Masterclass makes our list as the best overall technical analysis course. Traders that place trades on their own without automated trading systems may want to consider paper trading to fine-tune their skills. However, rather than jotting the trades down on paper, using a demo account, traders can practice placing trades to see how they would have performed over time.

We chose to target trading courses that focus on technical analysis because it is a specialized part of the trading process. In our initial search of technical analysis courses, we found more than 20 U.S.-based online courses. Anyone who has ambitions of generating profits through trading should take a technical analysis https://trading-market.org/10-technical-analysis-lessons-and-tips-for-day/ course. Having access to top-tier charts and analysis tools is critical for applying your knowledge. StockCharts is one of the best charting services that brings traders along with its standout Charting School. That makes the Bullish Bears our choice as the best technical analysis course for learning while doing.